Finance Guru Speaks: Just like I wrote an article on how you can open Fixed Deposit account in SBI through Internet Banking or Net Banking, similarly I have come up with the same idea for HDFC Bank.

You can also read:

How To Open Online Recurring Deposit Account in SBI Through Internet Banking?

How To Open Online Recurring Deposits (RD) In HDFC Bank Through NetBanking?

You need to have NetBanking feature enabled to open your FD Account online. Contact your HDFC home branch to open Netbanking facilities for your account.

Steps to follow to open online FD Account in HDFC Bank:-

1. Login to HDFC Bank NetBanking with your valid details.

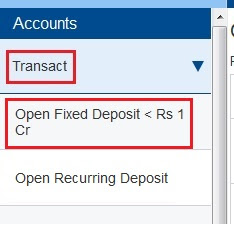

2. Once the page opens, on the left-hand side, click Open Fixed Deposit < Rs 1 Cr link present under Transact heading. It’s shown as below:-

|

| HDFC Online Fixed Deposit |

3. Open New Fixed Deposit page will be opened. Fill out the page as per your needs or follow the below picture. Click on Continue button once all the details are filled:

4. Accept the terms & conditions and then click on Confirm button.

|

| Click to enlarge - HDFC NetBanking FD Account Opening |

Congratulations!! You have successfully opened an FD Account Online through NetBanking in HDFC Bank. :-)

Some of the very important details shared by the bank are as follows:-

1. As per the Terms & Conditions of Fixed Deposit Accounts of the bank, the penalty on premature closure of Fixed Deposits including sweep-in and partial closures has been fixed by the Bank at the rate of 1%.

2. As per Section 139A(5A) of the Income Tax Act every person receiving any sum of income or amount from which tax has been deducted under the provisions of the Income Tax Act shall provide his PAN number to the person responsible for deducting such tax.

3. In case the PAN number is not provided to the Bank as required the bank shall not be liable for the non availment of the credit of tax deducted at Source.

4. As per section 114B (c) of the Income Tax Act, every person shall quote his permanent account number in all transactions about a time deposit, exceeding fifty thousand rupees, with a banking company to which the Banking Regulation Act, 1949 (10 of 1949), applies (including any bank or banking institution referred to in section 51 of the Act);

5. In case your PAN details are not updated with the bank, you are requested to visit the nearest branch and update your PAN details. In the absence of PAN, you may not be allowed to carry out certain transactions on Netbanking.

If you are a non-assesssee or do not have PAN, you are requested to visit the nearest branch. Your Fixed Deposit will be booked if permissible under the Bank's current policy.

If you are a non-assesssee or do not have PAN, you are requested to visit the nearest branch. Your Fixed Deposit will be booked if permissible under the Bank's current policy.

6. Further please note that the credit for the Tax Deducted at Source as governed by Section 194A is based on the eTDS return filed by the bank by quoting of VALID PAN of deductee's. In the absence of your PAN No. with the Bank, availment of the credit of TDS would be a hindrance, as the credit for TDS is denied by the Tax Authority where PAN No. is not mentioned in eTDS return.

7. In case you wish to book an FD under the 5-Year Tax Saving Scheme to avail of exemption u/s 80C of the Income Tax Act,1961, kindly visit your nearest HDFC Bank branch.

8. The Fixed Deposit will be opened as a regular FD, with a holding pattern, similar to the holding pattern existing in the Current/Savings account, from where the amount is being debited.

9. Individuals seeking exemption from TDS, have to submit a completed Form 15G/H at the bank branch within the first week of the new Financial Year.

10. To modify maturity instructions/updation of the nominee, you are requested to visit the nearest branch

11. The FD rate applicable for a monthly interest option will be a discounted rate over the standard FD Rate. Please contact the nearest Branch for further information.

12. In case you are a Senior Citizen (60 years and above) and would like to avail of a preferential rate of interest on your deposit, please approach your branch with proof of age. Once you are registered as a Sr. Citizen with the branch you will be eligible for a preferential rate of interest on all your FD bookings through the Net.

13. In case of NRO deposit no interest will be paid if the deposit is liquidated within 7 days of the date of booking.

14. In case of NRE/FCNR deposit no interest will be paid if the NRE/FCNR Deposit is liquidated before the completion of 1 year from the date of booking.

15. Physical advices will not be sent for Fixed Deposits booked through Netbanking. An electronic mail advice will be sent to you on your REGISTERED Email ID within 2 working days.

16. In case your email ID is not updated with the bank, you are requested to contact the nearest branch and update your email ID.

17. At any point, if you wish to check your FD holdings, the same may be viewed on the FD summary page on Netbanking. In case you wish to have physical advice, you may walk into the nearest HDFC bank branch.

18. A copy of the email advice may be submitted to the branch in case of premature liquidation of the deposit. The email advice copy is as acceptable at our branches as the physical advice.

Image Courtesy: HDFC Bank

Image Courtesy: HDFC Bank

If you like my work, then you can support me by subscribing to my YouTube Channel - FINANCE guru SPEAKS, and sharing this article over your Social Networks. Thank you. ✌

No comments:

Post a Comment

Thanks for your interest. Keep visiting.

Sincerely,

Finance guru Speaks