Finance Guru Speaks: Yes, you can open Recurring Deposits in SBI through Internet Banking. No need to stand in long queues and waste your precious time in the branch. You can avail of the facility with ease and it’s just a few clicks away!

6. Once your RD account opens, you can check its details under the section Deposit Accounts in My Accounts > Account Summary page, as shown below:-

Congratulations!! You have successfully opened your eRD Account using SBI Online Banking facility.

Important details provided by Bank:

- e-RD with an additional rate of interest for Senior Citizens will be issued if the option for "Senior Citizen" is selected by the customer and the age of the customer is 60 Yrs or above, on the date of creating the recurring deposit, as per date of birth recorded with the Bank. The minimum tenure and minimum amount applicable for additional rate of interest for senior citizens will be as per Bank's policy. "However, no additional rate of interest for senior citizens is provided under NRE and NRO term deposits."

- Kindly visit your SBI branch with your PAN card (original and copy) to get the same updated in the bank records.

- e-RD can be opened for a minimum of 1 year and a maximum of 10 years.

- e-RD can be opened only if the mode of operation is 'Single' or 'Either or Survivor' or 'Any A/c Hold or Surv' or 'Power of Attorney' or 'Letter Of Authority' or 'Sole Minor-Above 10 Year' or 'Nat Guard Of Minor' or 'Former or Survivor' and 'Latter or Survivor'.

- For e-RD, interest will be paid at maturity.

- The Recurring Deposit for 555 days and 1000 days tenors are not available.

- Although you are submitting the instructions online, the account itself will not be opened in Internet Banking but in Core Banking, which is the accounting system of the Bank. Hence the rules about the account as applied in Core Banking will apply to this deposit.

- Interest paid on premature withdrawal of term deposits could be less than the contracted rate, as per the applicable rule on the date of premature payment. To know the current rules, please click on Domestic term deposit, NRO term deposit & NRE term deposit

Images Courtesy: SBI Internet Banking website

Steps to open Online Recurring Deposits through SBI Online Banking:

1. Login to SBI Internet Banking Account.

|

| OnlineSBI Login Page |

2. Go to Deposit & Investment -> Fixed Deposit, as shown below:-

3. Click on Recurring Deposit (e-RD) link as shown below:-

|

| Click to enlarge - Open RD Account SBI Online Banking |

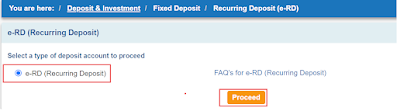

4. Click on Recurring Deposit (e-RD) link as shown below:-

5. Under Open new A/c section, fill in the details like RD Amount, RD duration, Set Standing Instruction, etc., and click on Submit button, as shown below:- |

| Click to enlarge - Open RD Account SBI Online Banking |

| Click to enlarge - Online RD Created in SBI |

Important details provided by Bank:

- e-RD with an additional rate of interest for Senior Citizens will be issued if the option for "Senior Citizen" is selected by the customer and the age of the customer is 60 Yrs or above, on the date of creating the recurring deposit, as per date of birth recorded with the Bank. The minimum tenure and minimum amount applicable for additional rate of interest for senior citizens will be as per Bank's policy. "However, no additional rate of interest for senior citizens is provided under NRE and NRO term deposits."

- Kindly visit your SBI branch with your PAN card (original and copy) to get the same updated in the bank records.

- e-RD can be opened for a minimum of 1 year and a maximum of 10 years.

- e-RD can be opened only if the mode of operation is 'Single' or 'Either or Survivor' or 'Any A/c Hold or Surv' or 'Power of Attorney' or 'Letter Of Authority' or 'Sole Minor-Above 10 Year' or 'Nat Guard Of Minor' or 'Former or Survivor' and 'Latter or Survivor'.

- For e-RD, interest will be paid at maturity.

- The Recurring Deposit for 555 days and 1000 days tenors are not available.

- Although you are submitting the instructions online, the account itself will not be opened in Internet Banking but in Core Banking, which is the accounting system of the Bank. Hence the rules about the account as applied in Core Banking will apply to this deposit.

- Interest paid on premature withdrawal of term deposits could be less than the contracted rate, as per the applicable rule on the date of premature payment. To know the current rules, please click on Domestic term deposit, NRO term deposit & NRE term deposit

Also Read: |

Images Courtesy: SBI Internet Banking website

If you like my work, then you can support me by subscribing to my YouTube Channel - FINANCE guru SPEAKS, and sharing this article over your Social Networks. Thank you. ✌

After creating this e-RD account, the monthly deduction process has not been done. What I have to do??

ReplyDeleteHello Suneeta,

DeleteThanks for visiting this blog. You need to set "Standing Instructions" feature to auto-deduct monthly RD amount. Please use "Set Standing Instruction" option available as - "e-Fixed Deposit > e-RD / e-SBI Flexi Deposit >Set Standing Instruction".

Let us know if you still find it difficult to find it.

Regards,

Team Finance Guru

Hi,

DeleteHad the same issue, so i set standing instruction.But what about the previous months installments? Actually i opened e-RD on 30Nov2015 and today i set STDR so dedeuction will start from 13Apr2016 till the maturity, so last 4 deductions missed. Now what should i do ?

hii...

ReplyDeleteI opened e-rd on 12th December and visited my branch on 14th December with pan.. but still the amount of rd is not deduct from my sb account. what should I do??

Hi Dhaval,

DeleteOnce the eRD account opens successfully, then it deducts the first installment at the same time of account opening.

You can first check whether your PAN is updated properly or not and if its updated in the bank records then you can cancel this RD account and open a new one.

If you don't wish to do above then visit your home branch or any other nearby SBI branch and check with them about the issue.

Regards,

Team Finance guru Speaks