Finance Guru Speaks: This article will provide you details on how you can open Recurring Deposit or RD account in Vijaya Bank through Net Banking.

No need to stand in long queues and waste your precious time in the branch. You can avail the facility with ease and it’s just few

clicks away!

Steps to open Online RD Account in Vijaya Bank using Net Banking:

1. Open Vijaya Bank Net Banking Login Page.

2. Go to Accounts and click on Open a Recurring Deposits Account link. It is shown below:-

|

| Open Online RD in Vijaya Bank |

|

| Open Online RD in Vijaya Bank |

4. Select the RD product and fill all the relevant details for opening the Recurring Deposit. Click on Submit Online button. It is shown as below:-

5. Check the details carefully and provide your Transaction Password as well as One Time Password (OTP) which you received on your registered Mobile No. Click on Submit button.

6. In the next screen, you will see a successful confirmation message of the newly opened Recurring Deposit account. Do note down the Reference ID for future reference.

7. In the Dashboard section on the Home Page, you can check details of the new RD Deposit.

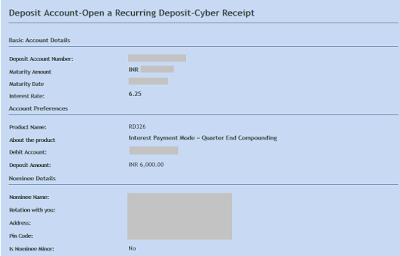

8. You can check RD Receipt:-

Congratulations!! You have successfully opened your RD Account using Vijaya Bank Online Banking facility.

Important details provided by Bank:

|

| Click to enlarge - Open Online RD in Vijaya Bank |

5. Check the details carefully and provide your Transaction Password as well as One Time Password (OTP) which you received on your registered Mobile No. Click on Submit button.

|

| Click to enlarge - Open Online RD in Vijaya Bank |

|

| Click to enlarge - Open Online RD in Vijaya Bank |

8. You can check RD Receipt:-

|

| Click to enlarge - Open Online RD in Vijaya Bank |

Important details provided by Bank:

1. Term Deposit can only be opened if the customer is an existing customer with an operative savings/current account. He/ She must possess valid login and transaction passwords for Internet Banking.

2. The Savings/Current account from which the term deposit is to be funded should be fully KYC complaint i.e. it should have a photograph, Identity proof, address proof, PAN details/Form 60-61 etc.

3. In case of Tax Saver Term Deposit, the period of deposit is 5 years only. Premature closure is disallowed.

4. Option to add nomination online is available. However, witness is required in case of illiterate depositors.

5. Auto renewal facility is provided on the rate applicable on date of maturity.

6. Premature cancellation/availing loan can be only done at the branch level. The customer has to visit the parent branch and has to complete required documentation formalities as these requests have an offline nature and need to be carried out as per instruction of user. For Tax Saver Term Deposit loan/pre-mature payment is not allowed during lock-in period i.e. up to 5 years.

7. For extension before maturity the customer has to visit parent branch.

8. If exemption from TDS is required 15G/15H has to be deposited at branch itself.

* For premature closure of E-Term Deposit , the customer has to provide a written request to the branch by furnishing details such as Deposit Account Number and Amount of Deposit.

* E-Term Deposit Receipt can be downloaded from Service Request>Query on Request .

* For Loan against E-Term Deposit, customer should take print out of the E-Term Deposit Receipt and approach the Branch.

Also Read: |

Images Courtesy: Vijaya Bank Website

No comments:

Post a Comment

Thanks for your interest. Keep visiting.

Sincerely,

Finance guru Speaks