Finance Guru Speaks: This article will provide you details on how you e-Verify your Income Tax Returns using Aadhaar.

Once you file your IT returns, you need to e-Verify it. Income Tax Return filed by Taxpayer is not treated as valid until it is E-Verified by the Taxpayer. In existing process, taxpayer can verify by sending signed ITR-V to CPC (Optional) using Courier or Speed-post.

The Income Tax Department has introduced a system of e-verification of returns as an alternate for sending signed ITR-V to CPC.

This requires you to be registered on Income Tax Department E-filing website and your details like Mobile No. should be linked with Aadhaar No.

Steps to e-verify your IT Returns using Aadhaar:

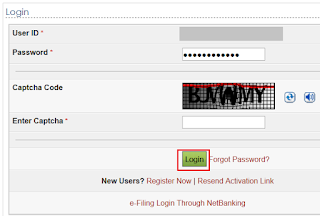

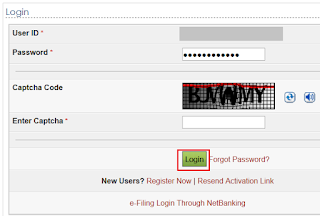

1. Login to

Income Tax Department e-Filing Website.

|

| Income Tax Website Login |

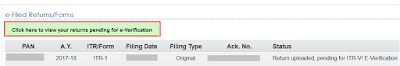

2. As shown below, click on

View Returns/Forms link under

Dashboard section.

|

| e-Verify IT Returns |

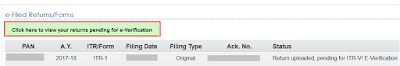

3. Click on link

Click here to view your returns pending for e-Verification as shown below:-

|

| e-Verify IT Returns |

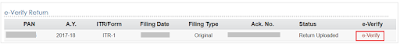

4. Click on link

e-Verify as shown below:-

|

| e-Verify IT Returns |

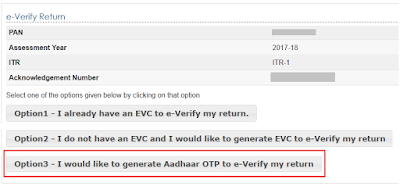

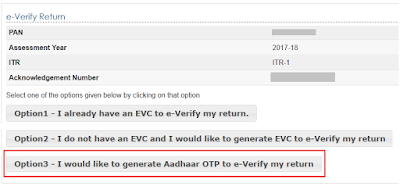

5. In the next screen, click on

Option 3 as shown below:-

|

| Click to enlarge - e-Verify IT Returns |

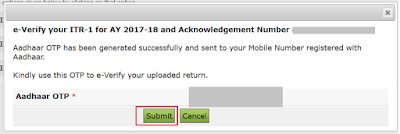

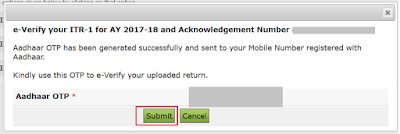

6. You will now receive OTP on your Mobile No. registered with Aadhaar. Enter OTP and click

Submit :-

|

| Click to enlarge - e-Verify IT Returns |

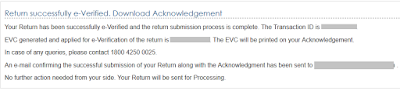

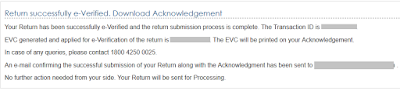

Congratulations on successfully e-Verifying your IT returns using Aadhaar :-)

|

| Click to enlarge - e-Verify IT Returns |

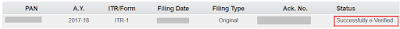

|

| Click to enlarge - e-Verify IT Returns |

Also Read

Images Courtesy: Income Tax Department Website

Please share this article over social networks. For more Learning, Please visit "At A Glance" Section.

No comments:

Post a Comment

Thanks for your interest. Keep visiting.

Sincerely,

Finance guru Speaks