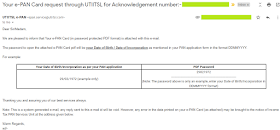

Finance Guru Speaks: This article will provide you detail on how you can generate or download your

e-PAN Card. PAN applicants can download their e-PANs directly using the steps mentioned in this article, provided they have issued their PAN through

UTIITSL.

|

| Download Your e-PAN Card |

e-PAN Card becomes very handy especially when due to any reasons you haven't received your physical PAN Card.

Steps to download or generate your e-PAN Card:-

1. Open

UTIITSL Website by clicking

here.

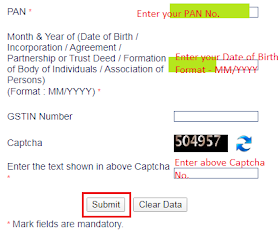

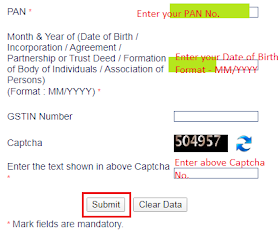

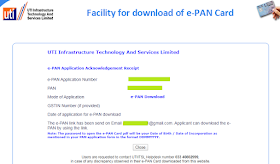

2. Enter your

PAN No. and

Date of Birth (MM/YYYY format) and click on

Submit button:-

|

| Click to enlarge - Download Your e-PAN Card |

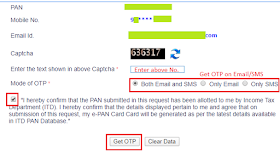

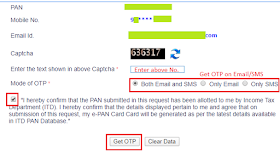

3. On the Next page, generate

OTP on your registered

Email/SMS. Click on

Get OTP button as shown below:-

|

| Click to enlarge - Download Your e-PAN Card |

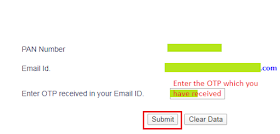

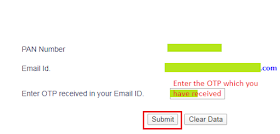

4. On the Next page, enter the generated

OTP and click on

Submit button, as shown below:-

|

| Click to enlarge - Download Your e-PAN Card |

5. If payment is required then make the payment through

UTIITSL's Online Payment Gateway, as shown below:-

|

| Click to enlarge - Download Your e-PAN Card |

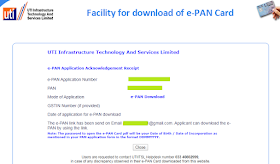

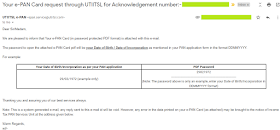

6. Once the Payment is successful, you will receive below confirmation from UTIITSL and the e-PAN Card will be sent to your registered Email Address:-

|

| Click to enlarge - Download Your e-PAN Card |

Congratulations to generating your e-PAN Card and receiving on your Email ID.

|

| Click to enlarge - Download Your e-PAN Card |

NOTE: The password to open the attached e-PAN Card pdf will be your Date of Birth / Date of Incorporation as mentioned in your PAN application form in the format DDMMYYYY.

Important Instructions Mentioned in UTIITSL Website:-

The e-PAN download facility on this website is available only for the users,

- who have applied for fresh PAN or applied for latest change/correction update with UTIITSL, and,

- who have earlier registered a valid and active mobile number OR email with their PAN record with Income Tax department.

The users can get the link for downloading their e-PAN in PDF form from this website absolutely "free of cost" only if their e-PAN was issued within last one month's time on their fresh PAN application or their change/correction request.

For requests received after one month of last issuance of their e-PAN, the users shall have to make an online payment of Rs.8.26 (inclusive of taxes) against every download of their e-PAN through this website

- The link will be sent to user's registered mobile number through SMS and/or to email and by clicking on this link, the user can download the e-PAN using OTP received on mobile/email.

- In case the user's mobile number and email are not registered, the user should get this done first by applying through a change/correction request application to avail the e-PAN download facility later.

- The link will be available only 3 times for downloading of e-PAN, and not later than one month, at no extra cost to users.

Users are requested to contact UTIITSL Helpdesk number in case of any discrepancy observed in their e-PAN Card downloaded from this website.

Images Courtesy: UTIITSL Website (https://www.myutiitsl.com/)

Please help to share the article over your social network.

No comments:

Post a Comment

Thanks for your interest. Keep visiting.

Sincerely,

Finance guru Speaks