Finance Guru Speaks: This article will guide you on how to Buy Put (PE) Options in Zerodha.

Please read the complete article. I have shared 6 Tips at the end of the Article. Please comment, share, and like this article for constant encouragement.

To begin with, buying Put Option is also known as LONG Put position. In India, we denote Put Option as PE (Put European).

Steps to Buying Put Options in Zerodha:-

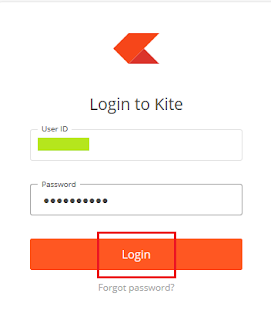

1. Login to Zerodha after clicking here. Provide your User ID, Password, and then your assigned PIN to Login.

|

| Zerodha Login |

|

| Zerodha Login |

|

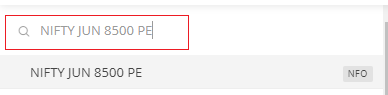

| How To Buy PUT Options in Zerodha |

| How To Buy PUT Options in Zerodha |

With INR 40 as your Buy Price, you need to pay a Total Premium of 40x75 = INR 3000 to the Seller.

It is a positional order, meaning we are not buying this Put Option for Intraday Trading. Once you fill all the details, click on Buy button:-

|

| Click to enlarge - How To Buy PUT Options in Zerodha |

|

| Click to enlarge - How To Buy PUT Options in Zerodha |

Congratulations! You have successfully placed Put Options Buy Order. You can cross-check your newly created LONG PE Order from Orders -> Orders list. This Order gets executed as soon as Exchange finds a Seller at your requested Price.

|

| Click to enlarge - How To Buy PUT Options in Zerodha |

Sharing some Tips which can be helpful for you while buying Put Options:-

TIP 1: Always try to buy Put Options when the Volatility is low. Due to low Vega or Volatility, you can get a chance to buy Put Options at a cheaper price. Your idea should be to buy on low Volatility and sell on High Volatility.

TIP 2: You should Buy Put Options ONLY when you are very sure that the Stock or Index will go down and cross the lower Strike Price during the Series Expiry. If you are not too sure, then don't just buy it for the sake of making money. However, you can still buy Put Option if you want to Hedge your current open positions. More details about Hedging can be discussed in a separate article.

TIP 3: Try to buy the Put Options during the start of the Series so that you will get sufficient time to move to ITM. Theta or Time decay affects the Premium very badly during the last week of the Expiry. So keep an eye on the dates and if you are making good profits in terms of Premium appreciation, then it can be a good idea to book the profits by exiting the position.

TIP 4: Remember, you will gain only if the Spot Price (Underlying Price during expiry) is less than the Strike Price - Premium Paid.

Strike Price - Premium Paid is your Breakeven Point after crossing which only you can make profits after expiry.

TIP 5: While buying, choose the Strike Price whose Delta is more than 0.4 value. In this manner, you can compromise on the cheaper premium paid and the probability to go ITM. However, if you are very sure about the Stock/Index down movement, then you can buy Strike whose Delta is greater than 0.6 or 0.5 depending on your premium paying capacity.

TIP 6: The Chances or Probability to win for Options Buyer is around 20% to 33%. Keep this fact in mind while investing your hard-earned money in buying the Options.

Note: Theta, Vega, Delta as mentioned in this article are known as Options Greek. If you don't have much idea about them, then a separate article can be written on their significance.

I am sure you may have so many queries around this topic. Please feel free to share your queries/comments on this article so that I can respond to you back via the Comments section. If required, I can write a fresh article as well on your queries.

Also Read:

Please help to like, share, and comment on this article over your Social Networks. Thanks.

Images Courtesy: Zerodha Website

No comments:

Post a Comment

Thanks for your interest. Keep visiting.

Sincerely,

Finance guru Speaks