Finance Guru Speaks: This article will guide you on how to Buy GOLDBEES (Gold ETF) in Zerodha.

Zerodha, as a Trading and Demat Account, has gained very wide popularity because of very low-cost trading and ease of use. If you don't have the Zerodha account, then you can open it through this LINK. It is very easy to open a Demat Account in Zerodha.

Please read the complete article. I have shared the relationship between Stock Market (Nifty) and Gold Prices. Please comment, share, and like this article for constant encouragement.

To begin with, buying Gold ETF means buying Gold in Demat form. It can be sold later on the NSE or BSE Stock Exchange. Gold is used for Hedging your Portfolio and it provides the necessary diversification.

Steps to Buy GOLDBEES Gold ETF in Zerodha:-

1. Login to Zerodha after clicking here. Provide your User ID, Password, and then your assigned PIN to Login.

|

| Zerodha Login |

| |

|

|

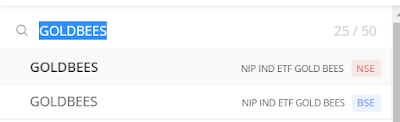

| How To Buy GOLDBEES Gold ETF in Zerodha |

|

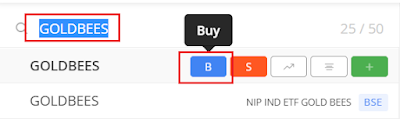

| How To Buy GOLDBEES Gold ETF in Zerodha |

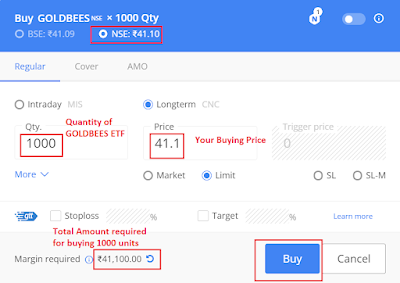

With INR 41.10 as your Buy Price, you need to pay a Total Amount of 1000x41.10 = INR 41,000 to the Seller.

It is a positional order, meaning we are not buying this Call Option for Intraday Trading. It is mainly for investment purposes.

Once you fill in all the details, click on Buy button:-

4. Once you click Buy, your Buy order gets placed in the Exchange.

Congratulations! You have successfully placed Buy Order for GOLDBEES. You can cross-check your newly created Order from Orders -> Orders list. This Order gets executed as soon as Exchange finds a Seller at your requested Price.

Sharing relationship between Stock Exchange and Gold Prices:-

In a theoretical manner, there is an inverse relationship between Gold and Stock Exchange. When Nifty or Sensex goes up, the prices of Gold go down or stay in a tight range.

Whereas when the Market crashes, investors tend to invest more in Gold for safety and diversification. Gold is used for hedging purposes and provides stability to the portfolio.

The below chart shows the Price Movements of Nifty and GOLDBEES on a Monthly chart. It is clearly evident that both move normally in the opposite direction.

|

| Click to enlarge - Stock Market and Gold Prices Relationship |

However, due to more and more awareness regarding investments and diversifications, Indian Investors keep on buying Gold ETFs on a regular basis via SIP mode.

To buy GOLDBEES at low prices, keep investing a small amount whenever Nifty goes up by 200 to 300 points. This way, you will accumulate Gold at cheaper prices. And, when Nifty crashes or gets into a bearish mode, you can start booking profits by selling your GOLDBEES units.

Also Read:

Please help to like, share, and comment on this article over your Social Networks. Thanks.

Images Courtesy: Zerodha Website

No comments:

Post a Comment

Thanks for your interest. Keep visiting.

Sincerely,

Finance guru Speaks